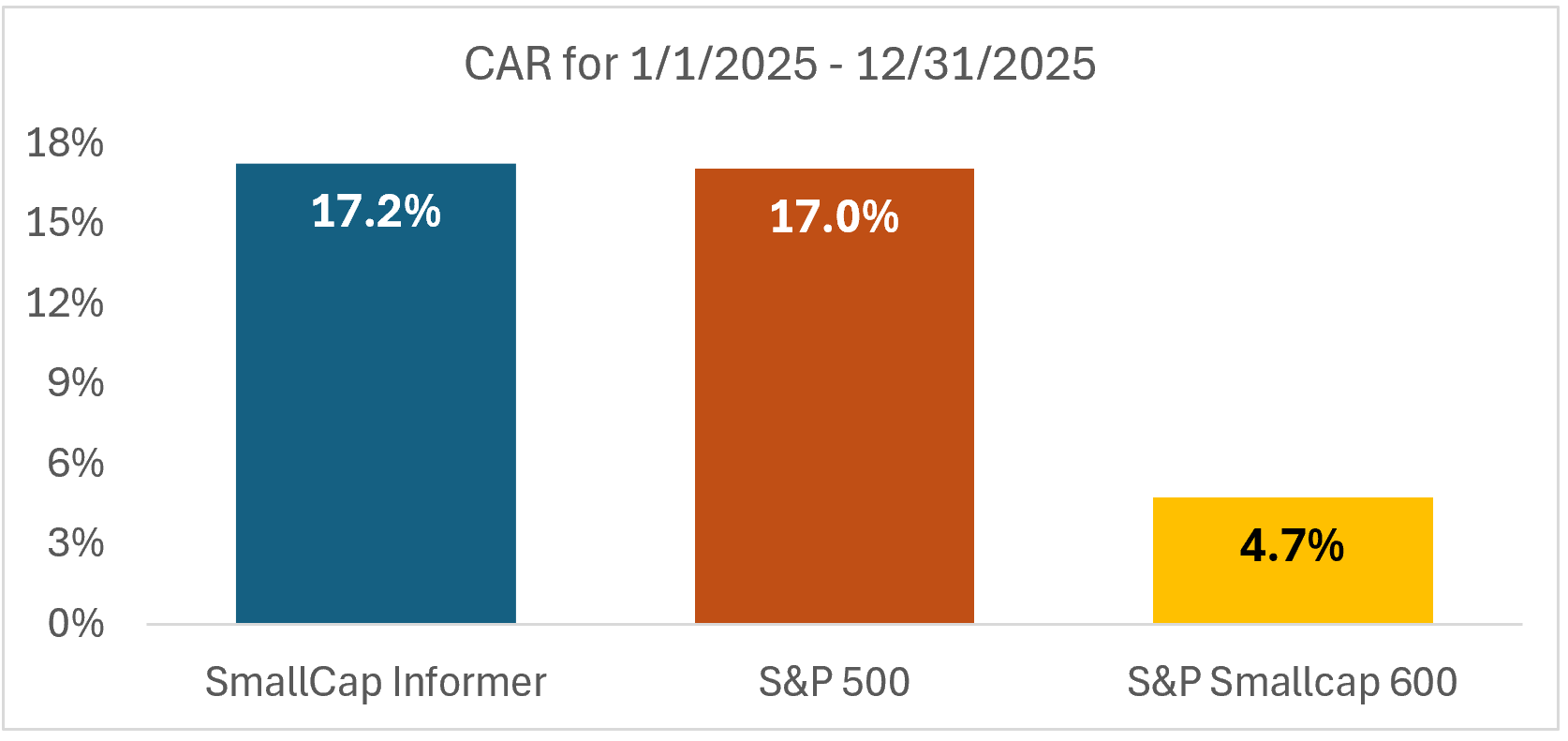

Our picks outperformed the S&P 500 as well as the S&P SmallCap 600 for the year.

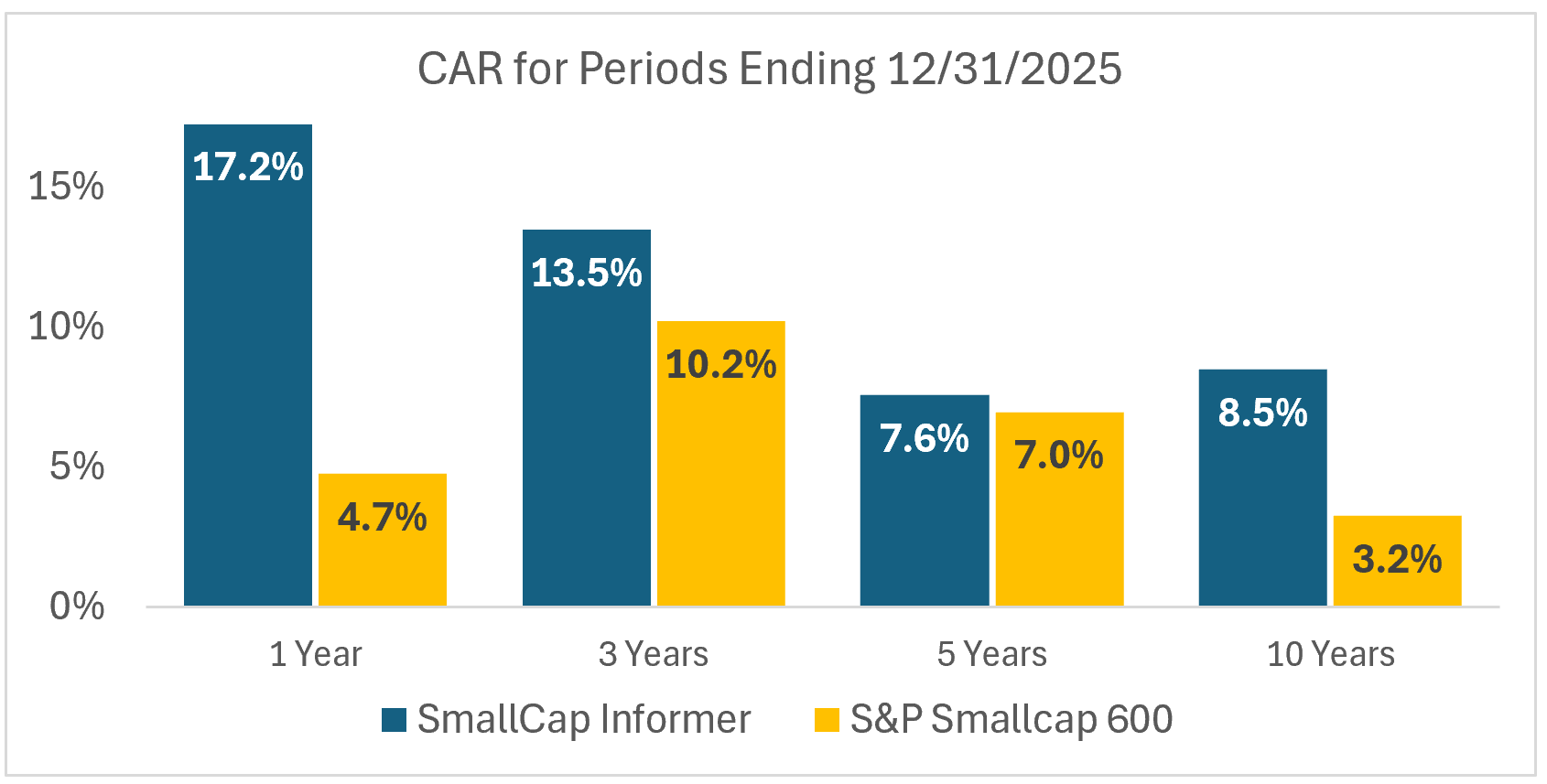

Results have been confirmed for calendar year 2025, and the small company stock selections in the SmallCap Informer turned in a terrific performance. For the year, our picks gained an annualized 17.2% compared to a benchmarked 4.7% for the S&P SmallCap 600 Index, outperforming the target index by a whopping 366%. Results for the last one-, three-, five-, and ten-year periods also remain consistently positive:

Perhaps even more impressively, the SmallCap Informer outpaced the 17.0% benchmarked rate of return for the S&P 500.

This is a rare feat in the mega-cap dominated market of the last several years. SCI has beaten the broad market previously, most recently in 2023 when our return reached 26.8% compared to the S&P 500’s benchmarked 26.24%.

SCI’s 2025 results were boosted late in the year by the performance of Nova and Fabrinet, two semiconductor-related companies that benefited from broad market interest in chip stocks. Powell Industries, Royal Gold, M-tron Industries, and Five Below also delivered outsized results for 2025.

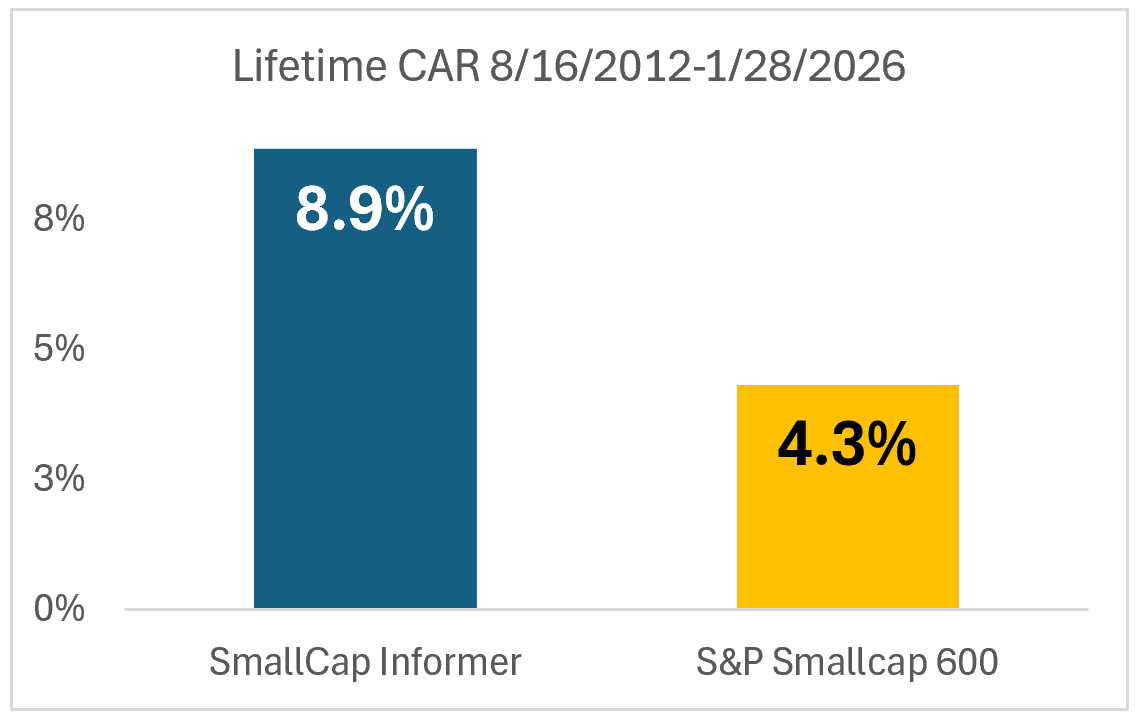

For the lifetime of the SCI newsletter (since August 12, 2012), performance remains strong relative to the S&P SmallCap 600 Index, more than doubling its rate or return. Our SCI stock picks in total have earned an 8.4% compound annualized rate of return compared to just 4.1% for the small-cap index.

Given the extended slump of small-cap stocks to large-caps that has occurred in much of the last decade, the extra edge provided by the SmallCap Informer’s picks offers stock investors portfolio diversification benefits but with a better rate of return than the index. (For more on our results, visit the Track Record page on the SmallCap Informer website.)

We are certainly pleased with our results for the year. Given the massive social upheavals of 2025, as well as the continuing domination of mega-cap stocks and mixed economic indicators, the results of the SmallCap Informer demonstrate the efficacy of our approach and suitability of our approach for individual investors. Subscribe now using the promo code CHARTER to save $100 on an annual subscription.

* * *

In this issue of the SmallCap Informer, we introduce a new company in the Farm Products industry, a fast-growing business with plenty to crow about.

Stay the course!

— DOUG GERLACH

Subscribers can read Doug's complete commentary and the in-depth profile of our recommended small company stock in the current issue of the SmallCap Informer stock newsletter. Not a subscriber? Subscribe to the SmallCap Informer and get monthly small company stock recommendations and updated buy/sell prices for each of the ~40 high-quality small company stocks currently covered in the newsletter.